You can protect yourself against losing money, this is called risk management.

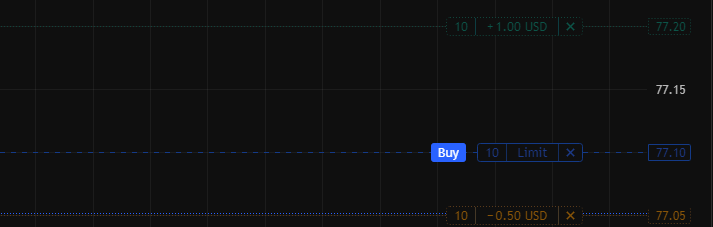

You do this by specifying a “stop loss” and/or “take profit” when placing your order.

Stop Loss

A stop loss automatically buys back (covers) your short position if the stock rises to a certain price, limiting your losses.

Example:

- You short at $100, expecting it to fall.

- You set a stop loss at $110.

- If the price rises to $110, your broker automatically closes the trade.

- You lose $10 per share, but you avoid unlimited losses if the price keeps rising.

Using a stop loss is the main way to protect yourself when shorting

Take Profit

A take profit automatically closes your position when the stock reaches a target price, locking in gains before the market can reverse.

Example

You short at $100, expecting it to fall.

You set a take profit at $90.

If the price drops to $90, your broker automatically buys back the shares and closes the trade.

You make $10 per share, and you avoid the risk of the price bouncing back up and erasing your profit.

Using a take profit is the main way to secure gains without having to watch the chart constantly.